Dead geckos and the state of the real estate agency industry

Posted by

urbanespaces

at

11:42 pm

0

comments

![]()

(More on) Real Estate Movies

Stephen Malpezzi has a very well-written essay on real estate movies.

It's a topic that I did not feel up to tackle- preferring instead, to limit the domain to movies concerning real estate agents as opposed to real estate as a whole- that'd definitely include every haunted-house story(my favourite's La Casa dalle finestre che ridono, or The House with Laughing Windows- my introduction to the genre of giallo, the latter being something that I have maintained a morbid fascination with ever since), the carpet- baggers in 'Gone With the Wind'(taken up by Malpezzi) as well as stories on every evil real estate developer out there(Fountainhead- or is that about evil architects and Superman's Lex Luthor?- there's a precious quotation cited in Malpezzi's essay:'Stocks may rise and fall. Utilities and transportation systems may collapse. People are no damn good. But they will always need land, and they will pay through the nose to get it'. Sure beats Mark Twain's 'Buy land. They've stopped making it.') and just about every movie where the house somehow plays a central feature. - I'd start with Mr and Mrs Smith or that cool loft in Hitch(Hollywoodbitchslap says that 'the loft interiors were shot from real lofts in TriBeCa and SoHo, with spectacular views of the Manhattan skyline') Malpezzi cites Citizen Kanes' Xanadu and Akira Kurosawa's Hidden Fortress.

Anyway- do check out Malpezzi's essay. I found the inclusion of HouseSitter and Beetlejuice to be especially inspired.

Posted by

urbanespaces

at

10:12 pm

0

comments

![]()

Discount Brokerages

There's a lot of buzz going on about discount brokerages on US-based real estate blogs. At 6% commission on a sale, I'm sure there's a market for discount brokerages.

In Singapore, where the standard agency commission is between 1-2% on a sale, talk about discount brokerages has hardly registered- although recently there has been a lot of debate on the practice of buyer's agents paying the 1% commission for a purchase transaction on a HDB flat.(Read about the debate here )

I do remember though, an agency advertising cash back schemes (not to be confused with HDB's cash back ) where the buyer does his/her own property search through calling up various seller's agents through the classifieds, arranging for their own viewings with these individual seller's agents and then inform the seller's agents that they are being represented by their own agents when they are ready to make an offer. The incentive in doing all the legwork yourself and then calling in the 'discount brokerage' to represent them is that the discount brokerage would be willing to share their commission with you and would return you a certain percentage of their commission.

Am not sureif it's the best way, or most ethical way of conducting a home search, however. The theoretical basis is that the buyers would do all the legwork themselves, organising for viewing schedules and making their own way between viewings. What it could degenerate into is an abuse of the seller's agent's time- where the buyer has various seller's agent picking out a few properties for them , arranging for viewing schedules, and then bring up the matter of representation when they are ready to make the offer.

Sellers' agents are also wont to consider buyers who call in directly as 'their clients' , - which would obligate the buyers to inform every seller's agent they contact that they are being represented by their own agent from the start.

As for the maths- and I'm sure this has been touched upon in a different context elsewhere- co-broking effectively halves the commission for sellers' agents. Which makes them unwilling to negotiate on the asking price. And should we look at the overall picture- where the commission is 1% of the total sale price, the savings could potentially work in the buyer's favour in the case where there isn't any co-broking. Am going to throw hypothetical figures(which in all likelihood would be very much tempered in real life):

On a purchase price of $1m, the agent gets a commission of $10k.

Upon co-broking, it's effectively $5k for each agent- with the discount brokerage giving you a refund of, say, 50%, which equates to a saving of $2500 for the buyer.

In the circumstance where there is no co-broking, however, the threshold for negotiation vis a vis how it affects the agent's commission is a lot higher. Should the purchase price be negotiated down to $800k(might or might not happen in real life depending on the seller's reserve price- but for this example connotes savings of $200k off the purchase price), the commission is still $8k as opposed to the co-broking fee of $5k at $1m-which would indicate that there is a greater incentive for the agent to negotiate on a lower sale price(although in real life there's the issue of agent loyalties- the relationship with an established as opposed to a new client, etc). In real life, co-broking scenarios are common, with very little resentment on the part of the agents involved but sometimes, as the above(rather extreme but illustrative of the message) example shows, the savings in a cash-back, discount brokerage might not justify the overall price paid.

The issue of reconciling agent's motivations/loyalties and the commission structure has been much debated- from Freakonomics to an excellent article I read in the Business Times a few years ago. Agents understand the motivation that comes with commissions and I have met agents who volunteer to pay for the agent's commission(they're on the buyer end in a private market- not typically necessitating a commission) should the transaction value be perceived as being too low to motivate an agent to source for apartments for them. Or the agents who buy their own apartments without trying to get a cut off the commission through co-broking because they understand it disincentivises the negotiation process.

Will continue touching upon the commission/motivation structure, and if there is ever an ideal model in later posts.

Update:-

Philip Greenspun suggests the 6% commission fees might be too low:

People who sell $1 million condos often complain that paying a 6 percent standard (read “fixed by collusion” among realtors) commission is too much ($60,000 for what might only be a few days of work). Economists who have studied the real estate market, however, find that in some ways the commission is too low because realtors don’t work very hard to sell clients’ houses compared to their personal houses. In other words they sell a customer’s house relatively cheap so that it will sell quickly rather than work for many weeks to get the best price and 6% of the extra.

Why haven’t we seen anyone propose a commission structure that says the realtor gets a 25% commission… but only on the amount above the assessed value of the property? Your typical $1 million NY or Boston apartment is assessed at maybe $850,000 and could be sold for that price with almost no effort in a few days so the commission paid on such a sale shouldn’t be more than $1000. If a realtor could sell the place for $1.2 million via clever marketing, however, she should be entitled to a fat commission.

And there's a precious quote on Singapore's commission rates and the kind of agents it spawns:

Posted by

urbanespaces

at

10:04 pm

0

comments

![]()

En bloc art

Image from 'Pages from a Dancer's Journal'

A dance choreographer, forced to move out of rented apartments more than five times over the last three years due to these apartments having been sold for en bloc has channeled her 'mental and emotional distress caused by the physical upheavals (of moving out)' into a new dance called Bleu.

From her interview with Straits Times' Arts reporter June Cheong, Elysa Wendi was quoted as saying: "Nowadays, people can just tear buildings down and rebuild them without feeling. Where's the trace of history from, say, 400 years ago?"

"Resembling a cross section of a collapsed house stripped down to its support beams, the set takes on an important symbolic role in the production, shutting her dancers out but hemming Liong's dancers in".- Straits Times, Life! August 23

Posted by

urbanespaces

at

10:03 pm

0

comments

![]()

FengShui Emperor Hat

I believe the emperor hat refers to a feng shui term, along with the allusions to support, strength and power. Also that the asking price is $8.8m- 8 being an auspicious number.

Posted by

urbanespaces

at

9:54 pm

0

comments

![]()

Interesting property ads, Aug 21st, 2007

The first entry to what I hope would develop into being a series.

I should have kept(or scanned) the earlier ads.

Someone put up an interesting ad in the papers!

Posted by

urbanespaces

at

3:15 am

0

comments

![]()

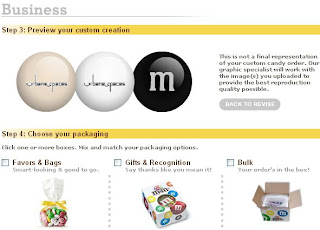

Customised M&Ms

For some time I'd thought about cupcakes(C-Cups' look very fashionable) but M&Ms with customised logos in colours of pearl, white and black look great too!

Via Cafe Fernando

Posted by

urbanespaces

at

5:27 am

0

comments

![]()

Hungry Ghosts May Spook Property Boom

Hungry Ghosts May Spook Property Boom

August- the month of the Hungry Ghost Festival, typically signals a slow month for property sales in countries like Singapore, Taiwan and Hong Kong. Since all the factors signal towards a quiet month(see excerpt from Reuters below),

"Hungry Ghost" month deals double blow to Asian business

By Fayen Wong | August 4, 2006

In Singapore, where 75 percent of the population is ethnic Chinese, business associations often run street performances, known as "getai," to entertain the living and the dead.

Apart from inviting popular singers from overseas to perform, these "getai" shows also include auctions for auspicious items such as oranges, pineapples and charcoal -- which are associated with wealth in Chinese, and which are stacked on gold-tinted plates and elaborately wrapped in red ribbons.

this month will be all about getai. From Rosyton Tan's 881 to the actual shows at your nearest spot of public assembly, the tradition of getai would be a fun distraction in a month otherwise characterised by slow sales and tumbling stock markets.

And since I was recently quoted in a local magazine saying that the job alternatives available to graduates of my batch were : real estate agents, taxi drivers and hawkers, please add getai singer to my list.

Photo below is of the winsome Mindy Ong in a very luxe getai costume. Both photos are from Royston Tan's blog

Posted by

urbanespaces

at

2:04 am

0

comments

![]()

Inflation and Real Estate- Or What Psycho Can Teach You about Inflation

What ‘Psycho’ can teach you about inflation

The price of cheap motel rooms, new bathrooms and Madison Avenue salaries in old movies are a lot more accurate than you’d think.

Via 360Digest

By Les Christie, CNNMoney.com staff writer

February 22, 2006: 2:19 PM EST

NEW YORK (CNNMoney.com) - $25 a day plus expenses. That’s what Sam Spade (Humphrey Bogart) charged to do detective work in 1941’s “The Maltese Falcon.”

Sometimes, money references in classic movies provide the jolt that reminds us of how inflation has changed what we pay for things. After adjusting for inflation, $25 in 1941 is the equivalent of $332 today — a PI today might get between $80 and $125 an hour (or more).

Sam Spade's $25 a day plus expenses is equivalent to about $330 today.

Sam Spade’s $25 a day plus expenses is equivalent to about $330 today.

Mike Myers skillfully exploited the disconnect in the first “Austin Powers” epic. The villain, Dr. Evil, who has just come out of a 30-year deep freeze, is holding the world hostage and demands . . . (portentous music) . . . $1 million dollars to spare it. After some consultation with henchmen, he ups the demand to $100 billion.

Even in 1997 dollars, when the movie was made, a million 1967 dollars only comes to a little under $5 million. Either Dr. Evil was a bit of a piker or the cryogenics had frosted some of his brain cells.

Here is a sampling of some classic movie money moments, complete with a rating of how surprisingly HIGH or LOW they seem from our perspective in 2006

Of Mice and Men: Cheap land?

Some movie prices seem totally divorced from reality. Lenny and George in “Of Mice and Men” are trying to scrape together $600 to buy a rabbit farm in the Salinas Valley. In California today, $600 wouldn’t buy a rabbit hutch.

Rating: LOW. The movie may be set during the Great Depression, but even adjusting for inflation, $600 then is only about $8,500 today. Perhaps Lenny and George were angling for a no-down payment, interest-only mortgage, intending to flip the property in six months.

Psycho: Cheap digs?

In the 1960 Hitchcock opus, “Psycho,” the room rate at the Bates motel is $10 (including a hot shower), which sounds pretty low, but it’s actually the equivalent of $66 today.

Rating: HIGH. Remember, this isn’t the Ritz; it’s a seedy place in the middle of nowhere that the new highway has bypassed, leaving it with no customers. For $66 you can rent a pretty good room in a chain motel and not have to worry about Norman’s mom.

Mr. Blandings builds his nest egg

Few movies spell out prices as completely as “Mr. Blandings Builds his Dream House,” the timeless tale of home buyer and home owner angst from 1948 starring Cary Grant and Myrna Loy. Of course the prices aren’t quite as timeless.

City dwellers Grant and Loy buy a rural Connecticut home on about 35 acres that is in such bad shape, demolition is the only solution. Purchase, demolition and construction ends up costing a total of $38,000 for a home with four beds and three bathrooms — the bathrooms costing $1,300 a piece. That translates into $308,100 total cost in 2006 dollars, with each bathroom going for $10,540.

Rating: Low. Even with all their overspending, the Blandings came out very nicely on their investment. The median price of a four-bed, three-bath home in that part of Connecticut would just over $600,000 today, and that’s with a small lot, not a sprawling 35 acres. The price of the bathroom is spot-on. A bathroom remodeling costs an average of $10,499 today.

Of course, despite Mr. Blandings’ worries during the movie about being stretched financially, he should have been able to handle his spending spree. He was earning $15,000 as a Madison Avenue copywriter. That comes to $121,618 today, (doing far better than Ted Kramer 31 years later). He should have been able to easily handle the $18,000 mortgage identified in the movie, which would have had payments of just over $100 a month, especially if he was able to scrape together the other $20,000 on his own. Top of page

Posted by

urbanespaces

at

11:36 pm

1 comments

![]()

The Next Neighbourhood- Redux

Photo above from hyacinthus.

I personally much prefer Arab Street for the interesting architecture and generally more sedate commercial mix. Do notice a proliferation of creatives heading for Joo Chiat though- a neighbourhood where there's a real mix between photography studios, karaoke joints and seedy bars.

Joo Chiat area fast becoming haven for creative industries

18 Mar 07

SINGAPORE: Rich in history and culture, Singapore's Joo Chiat area is fast turning into a hotspot for the creative industries.

Joo Chiat isn't just known for its hawker food – the area is also a smorgasbord of creative folks.

27-year-old Gayathrie Nahappan started her own art gallery this month.

Having cut her teeth in the arts scene in New York and Stockholm, the Malaysian-born artist could have opened her gallery anywhere in the world.

But she chose little old Joo Chiat in Singapore instead.

She said: "All my friends were like, ‘Why are you moving into Joo Chiat? It's not the best area, it's seedy and not safe’. But I said it's actually quite quaint and I like it for that. I felt like I was going back to the Chelsea of New York. Originally, the Chelsea of New York was just warehouses, now it's become an arts district."

By a rough estimate, Joo Chiat has about 20 to 30 creative companies.

Kamal Mahtanim, 28, is also one of Joo Chiat's newcomers.

He set up his recording studio here recently and loves the peaceful nature of the area.

"When the musicians and artistes come to Joo Chiat, the pace just drops. When they come here, it's a lot more relaxed and calm. This environment here in Joo Chiat will definitely give a lot of people a sense of calmness and everyone would be able to work at ease," he said.

But will the influx of the young and hip erode the charms that give Joo Chiat its unique flavour?

"I really do hope the youth preserve the Joo Chiat area because otherwise we're going to lose something of Singapore that we should really appreciate," said Ms Nahappan.

By Satish Cheney, Channel NewsAsia

__________________

Posted by

urbanespaces

at

10:06 pm

0

comments

![]()

The New Condominium- An exercise in Cross-Marketing

As Soleil@Sinaran partners up with Aramsa Spas to offer spa treatments, Scotts Square decides to partner up with local artists to bring art to the masses and developers partner up with doctors and spa owners to lend their masculine and feminine(respectively) touches to the showflat decor. Excerpts from the article can be found below:

Exclusivity the name of the game in high-end condo sales

4 Jul 06, Straits Times

Developers reach out to potential buyers with private viewings and 'Tatler crowd' parties

By Kelvin Han

THOSE ultra-luxury, ultra-pricey condominiums that make the headlines these days look like anyone's dream home but if you think you might get a glimpse inside one of these dream homes, think again.

Exclusive is the word here - especially when it comes to marketing.

Viewing property at this level means entering a rarefied world of 'Tatler crowd' parties, private viewings of expensively decorated show suites, discreet dinners for potential buyers and auctions that ensure the in-crowd remains desirable.

Take Keppel Land, which recently invited two prominent figures in society, spa and beauty chain owner Ponz Goo and eye specialist Steve Seah, and a third mystery person, to unleash their personal decorating styles on show suites at its Ritz Residences. A series of invitation-only parties were then thrown for friends and possible buyers.

The parties were meticulously planned and executed. 'We don't stint on the catering and entertainment, and attention is paid right down to the grooming and deportment of the sales staff,' he said.

'Privacy is very important for that segment of the market, so deals were done over dinner one on one or in small groups,' he said. Oh, and by invitation only, of course.

Other developers also taking the no-expense-spared approach to wooing the well-heeled buyer.

Naturally, that impression is achieved when 'you have private functions where guests arrive in Rolls-Royces and you can be seen in the company of the who's who crowd', he added.

Interested bidders must pre-register before attending the sale - a move that keeps out the curious while also underlining the exclusive nature of the plots.

Posted by

urbanespaces

at

1:51 am

0

comments

![]()

Parody real estate agency- Ghetto Fabulous Realty

From the page:

An ideal buy for the do-it-yourself types. This pre-built foundation leaves everything up to you! This lot is all set for you to come in and create the home of your dreams.

And we thought we went the extra mile to fabricate a 'situation'.

Posted by

urbanespaces

at

12:57 am

0

comments

![]()

A vicar on crack: Estate Agent Decides 'Honesty' is the best policy

Again, lifted off growabrain:

All the charm and poise of a vicar on crack. Hall, cloak room, sitting room, kitchen, bathroom, parking and rear courtyard garden. Suit midget on a budget.'

Mr Bending said: 'I only write these things because they tickle me. Freedom of speech is what this country is famous for and you should be allowed to say whatever you want so long as it doesn't hurt anyone.'

The Diocese of Bath and Wells said it had no objections to the disparaging descriptions of vicars in the shop window.

Spokesman John Andrews said: 'We can't get upset. It's quirky and a bit heavy-handed. We don't need crack to get high. We're reaching for the heavens through spiritual means.'

Original Article can be found here:

There were a few ads in the local papers that attempted to invest some life into the houses for sale- something along the lines of 'hi, my name is dolly. buy me and dress me up.'

or 'i am a penthouse with a large roof terrace. plant your seeds on me on a clear night under the heavens.'

and in the aftermath of the asian tsunami, an ad that read 'invest in singapore- an island safe from natural disasters'. although that's sick, not funny.

these agents should advertise something fun soon. just so i can cut out those ads and scan them in (just to show i wasn't making them all up).

Posted by

urbanespaces

at

12:56 am

0

comments

![]()

Michael Slater

June 8, 2005 @ 10:28 am

6When I sold my house in the east bay of San Francisco, this is exactly what I did. The commission was tiered and he was better paid the higher the sale price of the house was (starting at 6%) And to be clear, I got significantly more for my house (even considering that I had bought it only 11 months earlier… thanks California Real Estate Market!)

By the way, if you think 6% is low or a lot, consider what the real estate agents in Singapore get…. One Percent.

And yes, the average real estate agent here is about as good as you’d expect for paying only 1%. It’s practically a hobby job for most of them — a bunch of Glen Gary Glenross losers, they don’t even get the steak knives.